Get Your Massage Business EIN

This article will explain what an Ein number is and why you need one. I will also walk you through the easy steps to obtain your massage business EIN quickly online.

What is an EIN?

- A Employer Identification Number (EIN) is also known as a Federal Tax Identification Number, and is used to identify a business entity.Think of it as essentially a social security number for your business.

Why do I need your Massage Business EIN?

- You need an EIN to open a bank account using your business name.

You need an EIN for federal and state tax purposes if you are a sole proprietor using a business name other than your personal name.- You need an EIN if you are operating as an LLC.

When do I not need an EIN?

- You are a Sole Proprietor -and-

- You are using your personal name for your business name –and-

- You are using your personal bank account to deposit your business income and pay your expenses.

Caution: Even though you can operate your massage business without an EIN number if you meet the criteria listed above, it’s not recommended. Check out the following article to find out why.

Related Article: 10 Hazardous Mistakes Massage Therapists Make with Money

Step-By-Step Guide To Obtaining Your Massage Business EIN

Step 1: Go to the IRS.gov page to start your application

Click here to get your EIN number online

Read the directions and then click the’Begin Application’ button.

Step 2: Choose Your Business Structure

Most of you will choose either ‘Sole Proprietor’ or ‘LLC’.

Step 3 Through Step 9 Is For LLC’s

(See step 10 through step 14 if you chose ‘Sole Proprietor’)

Step 3: If You Chose LLC

If you chose ‘LLC’, read over the description on this page to make sure you understand what it is.

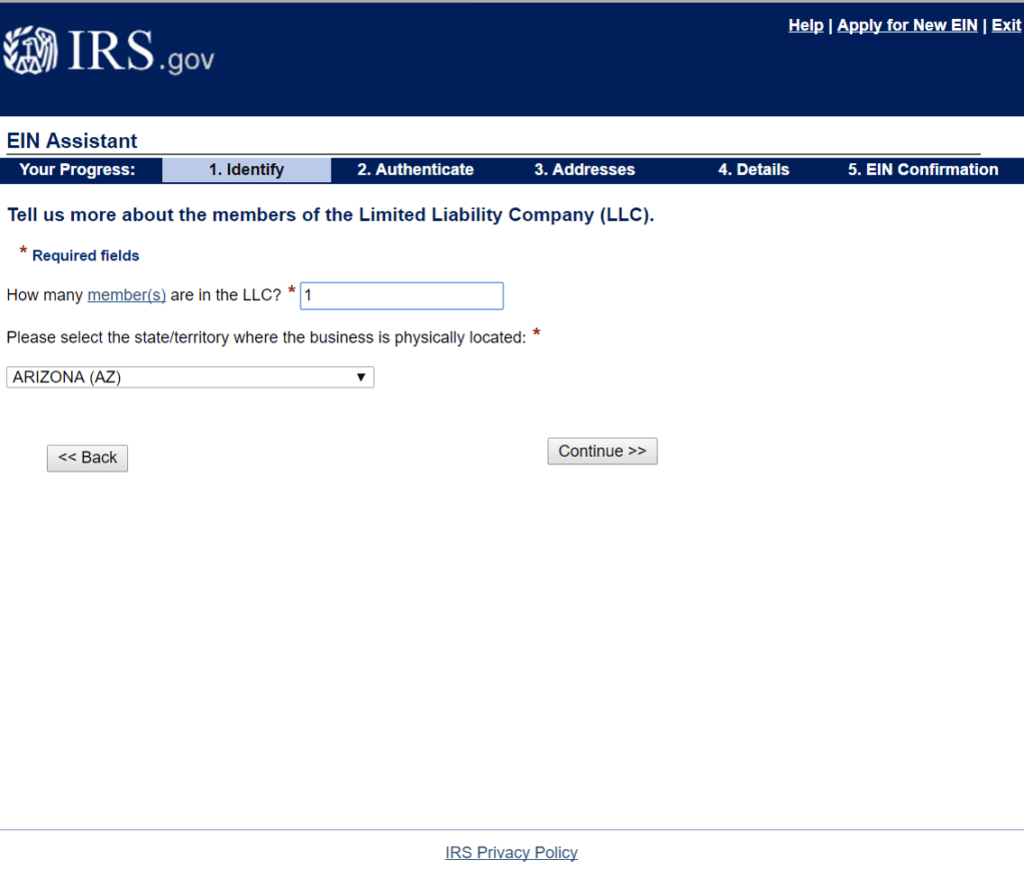

Step 4: Select Your State and Number of Members

Enter ‘1’ if you are the only member and select your state from the drop down menu.

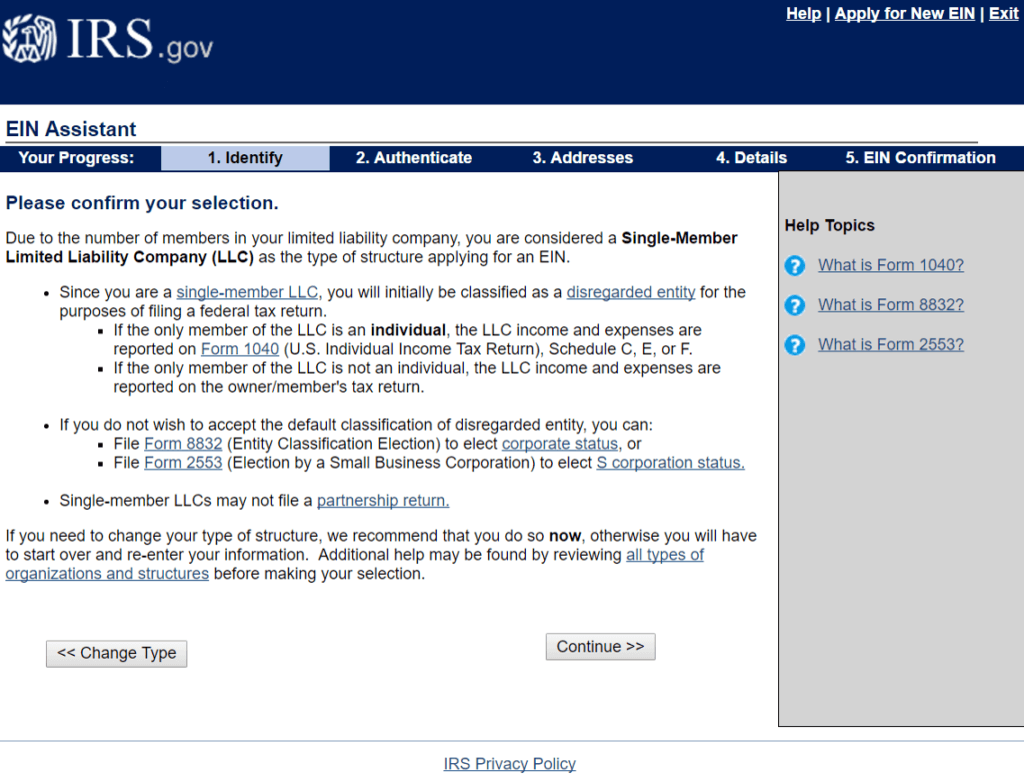

Step 5: Confirm Your Choice

Confirm that you have chosen ‘Single Member LLC’.

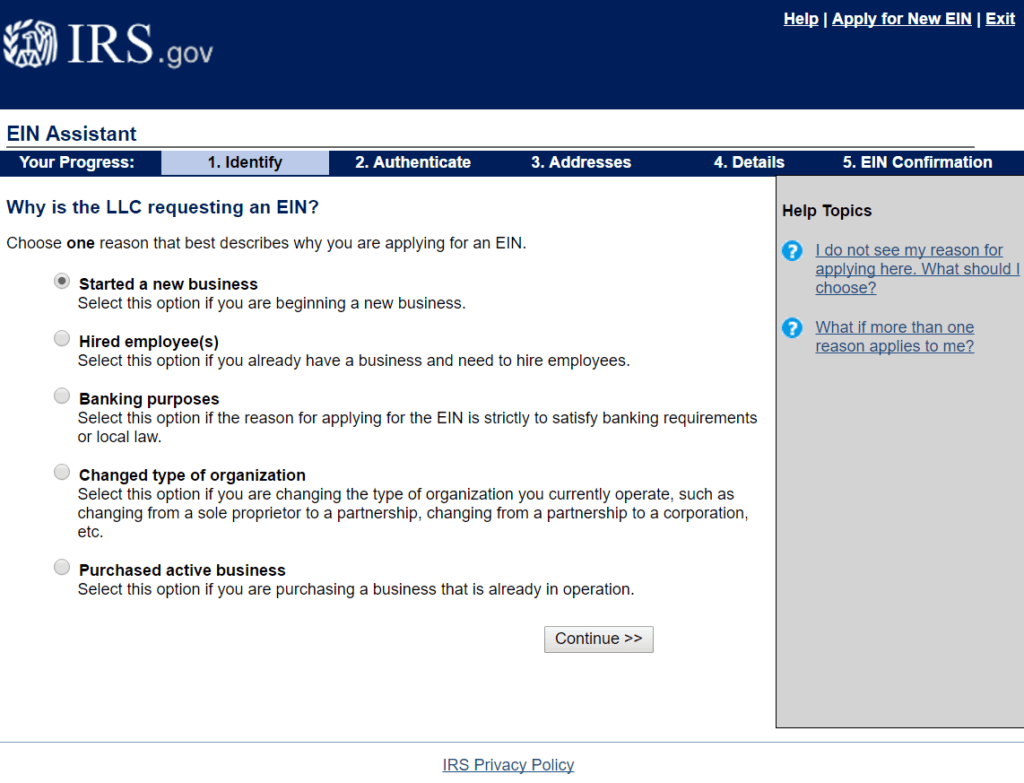

Step 6: Why Are You Requesting An EIN?

Chose the reason for requesting an EIN.

Step 7: Who is the Responsible Party of the LLC?

In most cases you will choose individual if you personally are running the LLC.

Step 8: Enter Your Personal Information

Enter your name and Social Security number.

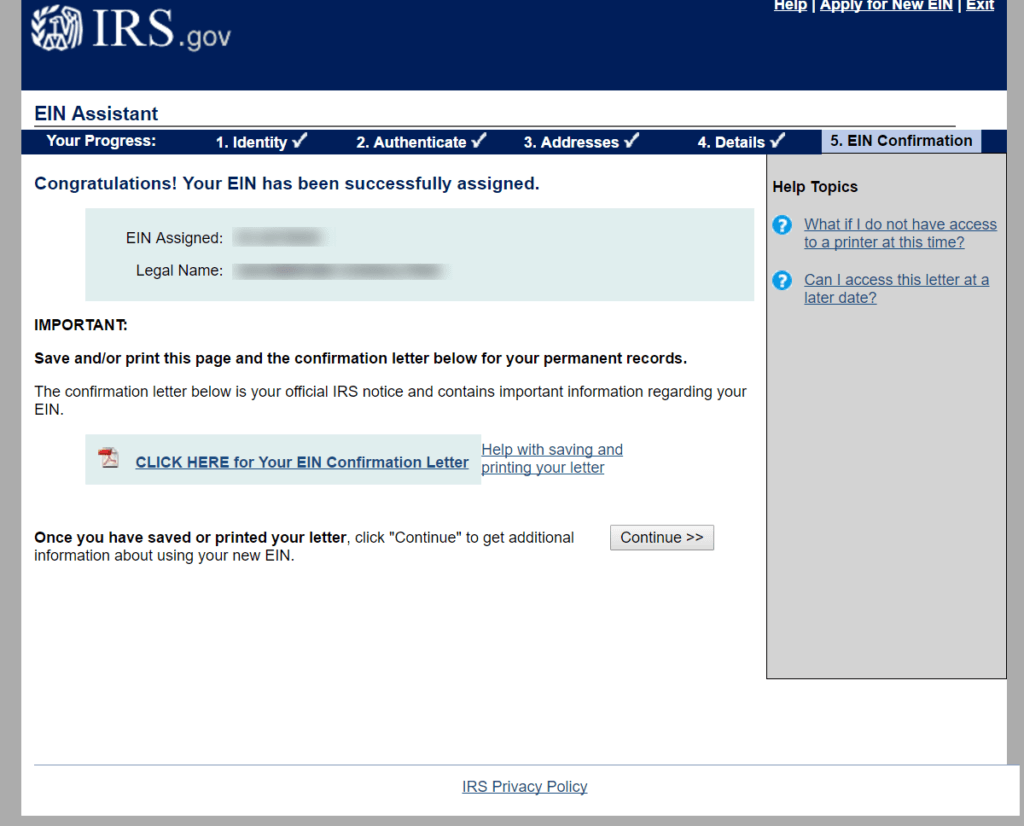

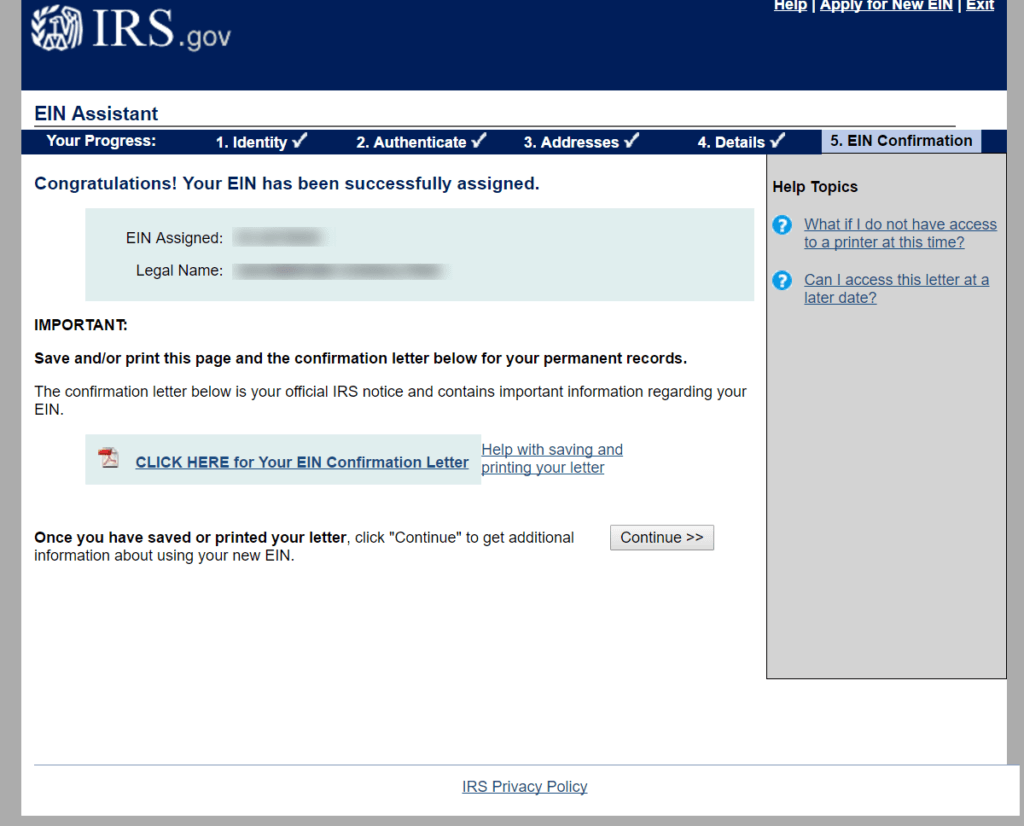

Step 9: Congratulations!

You did it! Make sure you write down your EIN and print out the confirmation letter. You may need the letter when you open your business bank account.

Step 10 Through Step 14 Is For A ‘Sole Proprietorship’

Step 10: Choose Your Sole Proprietorship Type

If you chose ‘Sole Proprietor’ in the last step then you need to choose it’s type here. In most cases you will choose the “Sole Protector’ option not the ‘Household Employer’ option.

Step 11: Confirm Your Choice

This page makes sure you know what you have chosen.

Step 12: Why Are You Applying?

This page asks you why you are applying for an EIN number. In most cases you will choose the ‘Starting A New Business’ option. Read the other options to see if they are a better choice for you.

Step 13: Enter Your Personal Information

Type in your full name and Social Security number. Choose the ‘I am a Sole Proprietor’ button.

Step 14: Congratulations!

You did it! Make sure you write down your EIN and print out the confirmation letter. You may need the letter when you open your business bank account.

Need More Information?

The Small business Administration (SBA) has a great resource guide on their website. Check it out here.

Conclusion:

Getting an ‘Employee Identification Number’ for your business is one of those steps that is necessary if you want to avoid potential legal and tax problems down the road. The great thing about it is that it is relatively painless and it only takes a few minutes to do. There is no cost involved and you can do the whole process online. You will need one if you are setting up a separate business bank account (which I highly recommend). If you are setting up an LLC, an EIN is required.

I hope you found this article helpful. Please leave a comment below and let me know if this helped you with the process of getting your business EIN. Please spread the word and share this article on Facebook, Twitter or you can pin the image below to your Pinterest board. I wish you success and prosperity.