Get A Massage Business Bank Account For Free

It is very important to have a massage business bank account that is separate from your personal account. If you are starting a brand-new business or if you have been running your massage practice for a while, you could be losing money by not having one. You could also be setting yourself up for some major headaches down the line. In this article I will cover the important reasons for having a separate business bank account and how you can set one up for free.

Save Money

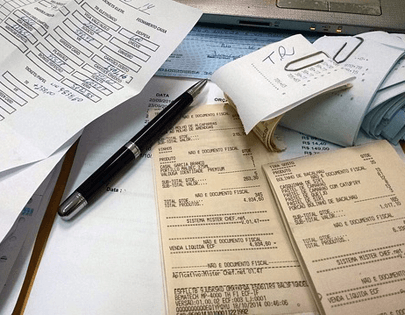

Most of you know how important it is to keep track of your business expenses. Other than the price of your services, there is nothing that can affect your bottom line more than understanding and keeping track of all your expenses. When it comes time to do your taxes, expenses come right

off the top of your income before your tax is calculated. This is especially true for what you eventually pay in self employment taxes. These are the taxes that you pay even if you don’t make enough to pay income tax. Making sure that you keep track of every single expense will in turn lower your tax obligation and you will pay less.

Keeping Track

We all believe that we will remember what we spent on our business whether it is the lotion that we use or that last continuing education class. It’s human nature though to forget things, especially over the course of a year. Maybe you forgot to put that receipt in the expense folder or you

ordered something online but you forgot to write it down.You can make it easy on yourself by setting up a separate bank account for your business with a separate debit card and checks (if you need them). By doing so, come tax time you will have everything in one place and hopefully will have not missed a penny of expenses. In the long run this can save you a tremendous amount of money and also will make it much easier on you and your accountant when April 15th comes around.

Why Is It Important to Have a Massage Business Bank Account?

- Legal Protection: One of the main benefits of setting up your business as an LLC or a corporation is that it will give personal legal protection. If you co-mingle your finances (personal & business), you will jeopardize this protection. Therefore, it is important to have a separate business account.

- Tax Advantages: Using a separate business account makes it much easier come tax time. Your accountant will love you if you take this one simple step. This will also make it less likely for you to miss a business expense that could lower the amount of taxes you will pay.

- Credibility: Having a business bank account makes you more legit, not only in the eyes of your clients but also the IRS.

- Business Card Convenience: When you open up a bank account you will receive a Debit/Credit card. Having this card will make it easy to make purchases for your business and is also a great way to keep track of your expenses.

- Credit Card Processing: If you decide at some point to accept credit cards (you can use your smartphone with companies like ‘Square’), having a business bank account to deposit the funds is essential.

Information provided by Stephanie Morrow College Professor.

Article provided by LegalZoom. Read the full article here.

Costs

Many banks charge you for a business account (Chase -$12/month, Bank of America -$14/month) unless you maintain a minimum balance ($1,500). There is no need to pay for a business bank account, though, when there are many free choices out there.

Free Business Banking

I recommend Spark Business Checking from Capital One. It’s easy to set up with no fees, no minimum balance and no transaction limits. You get a debit card that you can use at most ATM’s. I use Spark Business Banking and have been happy with it. Best of all, it’s free! Check it out.

What You Need to Open a Business Bank Account

The type of business structure you have set up for your business will determine what you need to provide your bank when you are setting up your account. An EIN is usually required but very easy to get (see article link below). If you are

- Business Name

- DBA (Sole Proprietorship) -or-

- Certificate of Organization (LLC)

- EIN Number

- Drivers license or ID

Related Article: Get Your Massage Business EIN

Related Article: Set-up Your Massage Business LLC

Tip: If you have been on my site before you probably already know that I recommend that you form an LLC for your massage business. It protects your personal assets (click the link above to read the article on getting an LLC). If you decide to use your personal name for your business and you are a ‘Sole Proprietor’, you can use a personal bank account for your business if you want. If you go this route, I recommend using a a separate account from your regular personal account so that you can keep your business expenses separate. If your looking for a free option with no minimum balance, I recommend ALLY Bank.

Get A Massage Business Bank Account For Free

Conclusion:

There are little things that you can do that can have a big impact on the success of your business. Having a business bank account is one of those things. It can help you do a better job of keeping track of your income and expenses. You can easily set up payment proccessing that makes it easier for your clients to pay (always a good thing). You will have everything at your fingertips come tax time and you can easily get a quick snapshot of your business.

I hope you found this article helpful. Please leave a comment below and let me know if this article helped you. Also, please share what business bank you use and what you like or don’t like about it. If you want to spread the word, please share this article on Facebook, Twitter or you can pin the image below to your Pinterest board. I wish you success and prosperity.

Get A Massage Business Bank Account For Free