Best Massage Business Tools: MileIQ

This free smartphone app makes it easy to capture all the trips you take for your massage business. Say goodbye to the headache of manually logging each mile. MileIQ automatically logs every single trip you take with all the information you need to provide your accountant for saving big money on your taxes. This is why I consider this installment of MyMassageBiz.com’s Best Massage Business Tools: MileIQ to be essential for the success of your practice.

MileIQ Remembers Your Drives So You Don’t have to

Catch every mile automatically. MileIQ’s drive detection makes it easy to capture every mile you drive. Say goodbye to the headache of manually logging every trip. Goodbye to the heartache of leaving dollars on the table when you forget. Hello to the ease of automatic mileage tracking.

Your Mileage Deduction with No Hassle

If you are already taking the 54 cents per mile deduction for your trips, I congratulate you. You are probably already saving big on your taxes. But did you know that the IRS requires you to keep meticulous records of every trip you take, complete with where you started, where you stopped, the date, time, number of miles traveled and the reason for your trip? If you don’t do this for every trip, you run the risk of having the IRS disallow your deduction. Keeping these records can take time and can be a hassle. You also run the risk of missing trips that could cost you lots of money.

Why is it important to have the MileIQ app?

It does the work for you.

You will never miss logging a business trip.

It logs everything that you need for the IRS.

It calculates your tax savings automatically.

It gives you the ability to file the drive as a personal or business trip.

You can print out a detailed report for your taxes.

You can save a lot of money.

Feature Highlights

Best Massage Business Tools: MileIQ

Catch every mile automatically

Automatic drive detection makes it easy to capture every mile you drive. Say goodbye to the headache of manually logging every trip. Goodbye to the heartache of leaving dollars on the table when you forget. Hello to the ease of automatic mileage tracking.

Automatic drive capture

Accurate and reliable tracking

Comprehensive mileage log

Minimal battery use

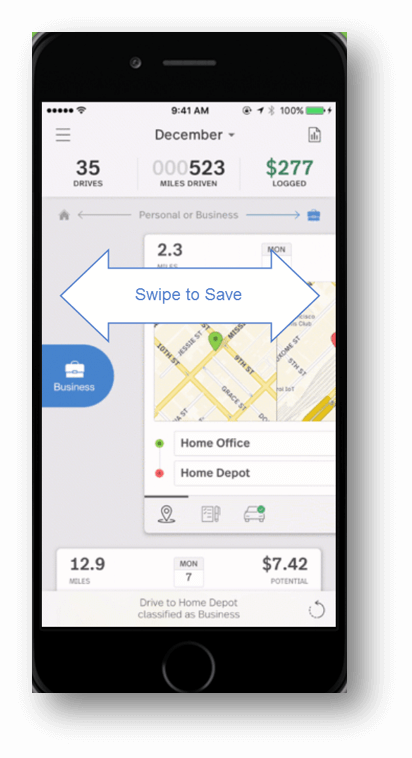

Classify every drive effortlessly

Give your drives a purpose; a swipe is all it takes. Mark them as business, personal, medical, charity, or any custom category you wish. Log any additional details you need for reporting mileage, such as client info.

One Swipe drive classification

Standard & custom purposes

Log additional drive details

Bulk & automatic classification options

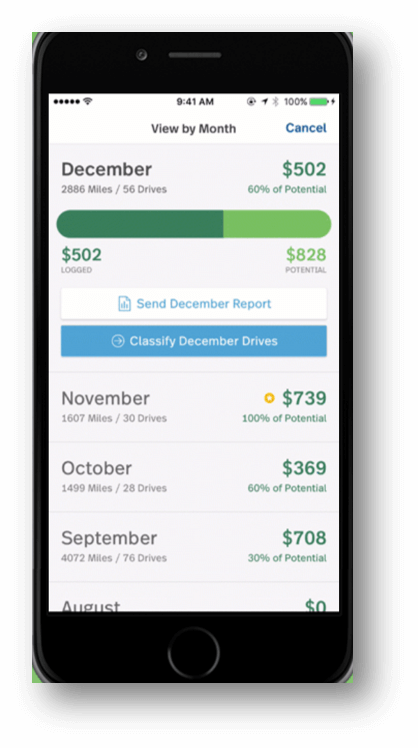

See what your miles are worth (Hint: A lot)

MileIQ automatically calculates the value of your drives, and at 54 cents/mile — the 2016 IRS standard mileage rate — it adds up FAST. You’ll have your complete drive history stored securely in the cloud, making it easy to provide detailed mileage logs any time to your employer, your accountant and, yes, even the IRS if they should ever ask.

Automatic and custom reports

Detailed drive history records

Support for mileage reimbursement

Support for mileage deduction

Important Note: The important thing that you need to know when planning to take a mileage deduction on your taxes is that you can only deduct trips that are for business. The IRS has some very strict rules on what constitutes deductible business driving, so it is important that you talk to your accountant about what you can use.

Read More: Mileage Deduction 101: Everything You Need to Know About Deducting Mileage for Business

Personalize to your heart’s content

No set-up is needed to start enjoying the magic of automatic mileage tracking. When you’re ready to personalize, you can set your preferences, add the vehicles, purposes and locations that define your driving and let MileIQ cater to your needs.

Vehicles and odometer readings

Editable mileage rates and units

Work hours & custom drive purposes

Email & notification preferences

You can depend on MileIQ

You have better things to do than worry. With MileIQ, you can be confident that your drive data is accurate, complete, and safeguarded by financial-grade security and an unwavering commitment to your privacy. If you ever need anything, their friendly and responsive support team is easy to reach and happy to help.

Data privacy

Secure cloud storage

No ads (even on free version)

Timely, responsive support

What Does MileIQ Cost?

FREE

MileIQ is free for the first 40 drives each month. For many of you this free version will be enough. If you do need to upgrade, it is only $5.99 per month or $59.99 if you pick up the annual plan. Try it now.

Even if you take more than 40 business trips per month, the cost of this app will be paid for many times over with the savings that you’ll achieve by using it.

Best Massage Business Tools: MileIQ

Click on the link below to get the MileIQ app for free.

Save an additional 20% and get the upgrade for only $47.99.

How To Sign Up For MileIQ

Below are the steps for getting the MileIQ app. The free version gives you 40 trips per month. If you find that you need to upgrade, you will save an additional 20% off the regular price when you use the MyMassageBiz.com/MileIQ link. You get it for a year for only $47.99. This app will save you money on your taxes plus you can write off the cost of the app, too!

Enter Email & Password

Signing up for MileIQ is fast, easy, and free! Enter your email and password and click ‘Create My Account’.

Save An Additional 20%

When you sign up for your MileIQ account through MyMassageBiz, you will save an additional 20% off your yearly subscription. You get it for $47.99 (reg. $59.99). You can get this discount anytime, so feel free to use the free account now, and then if you upgrade later, you will get the $47.99 price. Very cool deal!

Best Massage Business Tools: MileIQ

Conclusion:

Saving money on your taxes is one way that you can increase your chances for a successful massage business. Keeping track of your mileage is a great way to do this, but many of us don’t do this because it is a hassle. MileIQ makes it really easy. It keeps track of your trips automatically and all you have to do is swipe each trip into the business or personal category. It not only keeps track of your mileage but it also calculates your tax savings. When tax time comes, all you have to do is print the report and give it to your accountant or the person who prepares your taxes. If you are ever audited by the IRS, you have everything that you need to prove that the deduction is valid. MileIQ is one of those tools that most massage businesses cannot do without.

I hope you found this article helpful. Please, leave a comment below and let me know what you think of MileIQ. If you want to spread the word, share this article on Facebook, Twitter, or you can pin the image below to your Pinterest board. I wish you success and prosperity.